Fundamental and technical analysis of most popular currency pairs and commodities on Forex market, based on real trading conditions together with years of experience of online trading.

Sunday, January 28, 2018

Trading strategy without stop-loss orders

Stop-loss orders are useful. They limit your possible losses and execute an automated cut in case if the prediction was wrong. Most of FOREX courses teach a beginner to use stop-loss order on every single position they open, and this approach has a logical background.

But I noticed that there are lots of examples, when the price action reverses right after triggering my stop-loss and goes exactly in my direction without me in the market. I have loss in such case, instead of having profit after generally correct prediction.

Moreover, I was wondering why brokers teach beginners about to put stop-loss orders so insistently? The answer is simple. They have information about levels, where the biggest volume of stop-loss orders is placed, and this information allows them to hunt. Just try to think what happens, when a stop-loss order is triggered.

For example, you have a long position of EUR/USD with an entry price at 1.24000 and stop-loss order at 1.23500. Imagine a big market player, who have enough liquidity volume to move the market by injecting sell positions. The result is the slide of the price, reaching and triggering your stop-loss, which is a sell action. If your volume is big enough, the price action continues to fall, moving even lower for some distance. Let’s say 10 pips further South. What is the next action of such a hunter? He closes his short positions with profits at 1.23400 and opens long positions, according to the general trend. The price reverses and moves back to the level where it started if not above 1.24000. What do you have as the result: stop-loss triggered -50 pips. What does have that hunter as the result: DOUBLE profit +120 pips.

Of course, small traders do not have even a chance to compete with huge market players due to the difference in volume. But they can have accounts deep enough to withstand such a temporary price actions. And small traders can be smart enough to realize that these movements are fake.

The strategy to trade without stop-loss orders is dangerous, so traders must have an accurate calculations of possible negative impacts like margin call, and use risk management rules in a highly disciplined way. Timing is also crucial. Traders who use weekly trading plan have to be patient enough and be ready to add a second barrel of their positions in the same direction on a reasonable distance from the first entry point, in case if it went underwater and in case if the main trend direction has been chosen correctly.

Weekly trading plan

Every successful FOREX trader has to have a trading plan. There are a lot of different strategies when it comes to timing. It is very important to coordinate your targets and stop-loss orders with the timeframe of your trading plan.

My experience tells me about an important cycle in trading, which is one week. I usually work on my trading plan for a week ahead, and main job during the trading is to check if the suggestions were right and execute the plan according to the price action. Of course it is tough to have an exact prediction about possible retracement depth and exact time of reversals. But this timing helps me to maximize the profits and balance them with potential risks.

Before starting to work on my weekly trading plan, I analyze the previous week and double check all of the levels, that I targeted on my previous plan. It is very important to keep the direction together with the trend, and not to position trading against the market. I usually choose one direction according to bigger timeframes like weekly and daily. And I try to avoid attempts to catch all of the market movements. So if the price action goes against my prediction, I just stay out and use wait-and-see tactics.

This approach requires patience. A trader has to be like a sniper, camouflaged in a bush position, waiting for his target. Once he sees his target clearly, and once he is confident about good chances for his bullet to reach the target with one shot, he pulls the trigger.

There has to be a plan B though. The sniper has to be ready for a possible miss and prepare for a second shot. But this is another topic to discuss in the scope of trading strategy without stop-loss orders.

Tuesday, January 23, 2018

TOP 5 skills of a profitable FOREX trader

Most of beginners lose their first investment due to very common mistakes. This post is dedicated to the main directions, that every beginner should work in, developing skills which can help to become profitable in financial markets. These ideas come from the experience, most of these rules must be executed on daily basis. It’s also very important to make the analysis of daily trading, underlying main reasons of possible losses happened. Such a habit could help to avoid the same mistakes in the future, which is the main purpose of learning.

Psychology.

It is the main direction of beginner’s work, it does not have to be on the last place of the list, as many educational courses indicate. “If you cannot control your emotions, you cannot control your money”. Warren Buffett.

Two common features of human being have the most impact on your daily trading results: FEAR and GREED. Fear has different options like ‘fear of missing out’, when traders have a good analysis but open positions too early; and ‘fear to pull the trigger’, when the situation with the analysis is the same but there is no enough willing to make the decision. Greed makes you running for more profits after having first successful deals, and you jump into overtrading or forget about risk management rules.

Traders should not fight with the emotional features of human being, it is impossible. The best way is to CHANGE them with some more useful features. For example, I use logic to deal with my fears. I’m asking several questions to myself before opening any position. Instead of being greedy, I’m trying to be thankful to the market for giving me a profitable possibility.

Think big.

I know it’s not easy to put yourself in a shoes of a hedge-fund money manager, which operates billions of dollars. Especially if your account is small. But I ask myself couple of simple questions before entering the market: “What would I do if I was at such position? Is the current price of an asset attractive enough for me to buy/sell? Or should I wait for a better price?”

Most beginners are like a crowd of small animals, they have the same emotional guidance to run in the same direction. Big market players set traps to catch as many of them as it is possible. Remember couple simple rules: You make profits when someone loses. Buy when there blood in the streets and sell to the sound of trumpets.

Simple analysis.

Traders should avoid overthinking when they analyse the market conditions before entering. This leads them to a point when they trick themselves and get into own trap of complication. Most of the profitable positions have simple explanations. For example, you determine a long-term trend on bigger timeframe, wait for a retracement and join the party. Of course, fundamental and technical aspects have to be taken in count, together with money management rules.

Usually it happens like this. Technical picture draws some setup, fundamental event plays role of a trigger to start the technical setup workout. Traders need to be on the right side of the market and this is exactly the main purpose of your analysis.

Timing.

Let’s say you’re in the market. You have convinced yourself to buy/sell an asset. You have several fundamental and technical reasons behind this decision. All you need is just wait until the price will reach your target. You can close your position if something changes especially on the fundamental front, like a force-majeure or any unpredictable event. But if the environment remained the same, why would you close your position too early?

Profitable math is very simple. Minimize your losses and maximize your profits. Sometimes all you need is just to be patient enough and control your emotions. However, in case if you were looking for a reversal, and the position you entered continues to move in the same direction during a very short period of time like 15-30 minutes, you should admit your mistake and close it. Cause waiting too long could make you stuck with a lose.

Strategy.

Think big.

I know it’s not easy to put yourself in a shoes of a hedge-fund money manager, which operates billions of dollars. Especially if your account is small. But I ask myself couple of simple questions before entering the market: “What would I do if I was at such position? Is the current price of an asset attractive enough for me to buy/sell? Or should I wait for a better price?”

Most beginners are like a crowd of small animals, they have the same emotional guidance to run in the same direction. Big market players set traps to catch as many of them as it is possible. Remember couple simple rules: You make profits when someone loses. Buy when there blood in the streets and sell to the sound of trumpets.

Simple analysis.

Traders should avoid overthinking when they analyse the market conditions before entering. This leads them to a point when they trick themselves and get into own trap of complication. Most of the profitable positions have simple explanations. For example, you determine a long-term trend on bigger timeframe, wait for a retracement and join the party. Of course, fundamental and technical aspects have to be taken in count, together with money management rules.

Usually it happens like this. Technical picture draws some setup, fundamental event plays role of a trigger to start the technical setup workout. Traders need to be on the right side of the market and this is exactly the main purpose of your analysis.

Timing.

Let’s say you’re in the market. You have convinced yourself to buy/sell an asset. You have several fundamental and technical reasons behind this decision. All you need is just wait until the price will reach your target. You can close your position if something changes especially on the fundamental front, like a force-majeure or any unpredictable event. But if the environment remained the same, why would you close your position too early?

Profitable math is very simple. Minimize your losses and maximize your profits. Sometimes all you need is just to be patient enough and control your emotions. However, in case if you were looking for a reversal, and the position you entered continues to move in the same direction during a very short period of time like 15-30 minutes, you should admit your mistake and close it. Cause waiting too long could make you stuck with a lose.

Strategy.

Always remember about your goals. Why are you here? Are you intended to have fun or gamble and become addicted? So why are you crying about your losses in this case? Or do you want to make profits? How much and how long? What is the amount you can afford yourself to invest?

Any success must be planned.

Any success must be planned.

Saturday, January 20, 2018

EUR resistance before ECB.

The strength of EUR is determined not only by the weakness of USD, but also by traditional political and economical stability of the European Union. Low unemployment, strong wage growth and consumption, sustainable manufacturing production and export together with easy access to financial credit market at accommodative low interest rates, makes Eurozone very attractive for foreign investors from all over the world, including Asian and Middle East rich regions. These capital flows create an additional demand for EUR not only versus the USD, but also supporting cross rates like EUR/JPY, EUR/CHF, EUR/NZD, etc.

This past week, Eurozone positive economical reports were released: November Trade Balance; German, Italian and Eurozone CPI; EU current account. EUR/USD, as the most heavy trading volume currency pair, gained 0.19%, testing 3-year high rates on past Wednesday. The pair closed the third trading week in 2018 above significant technical and psychological level of 1.2220, showing a potential trend direction for whole year ahead.

Such a comparatively slow appreciation of the currency versus the greenback, was related to the upcoming important political decision in Germany, the biggest economy in Eurozone. This Sunday vote will determine the fate of the government, which still has not been created after October Parliament elections. In case if Social Democrats will approve Grand Coalition with Angela Merkel government, EUR/USD could continue bullish trend. But if the politicians will fail to finalize negotiations, there could be a negative impact for the pair, creating additional uncertainty for upcoming months.

Next week’s economic calendar is packed with important reports and events. Main focus is ZEW survey and IFO report, but traders and investors will wait for European Central Bank interest rate decision on Thursday, followed by ECB President Mario Draghi press-conference. On one side, the market players noticed a tweak from the regulator about possible tightening decision in “early 2018”, much earlier than was widely expected previously. On the other side, there could be a concern, expressed by ECB officials, about rapid EUR appreciation since the last meeting. Export-oriented economies like Germany might have additional competition pressure because of currency gaining strength.

This past week, Eurozone positive economical reports were released: November Trade Balance; German, Italian and Eurozone CPI; EU current account. EUR/USD, as the most heavy trading volume currency pair, gained 0.19%, testing 3-year high rates on past Wednesday. The pair closed the third trading week in 2018 above significant technical and psychological level of 1.2220, showing a potential trend direction for whole year ahead.

Such a comparatively slow appreciation of the currency versus the greenback, was related to the upcoming important political decision in Germany, the biggest economy in Eurozone. This Sunday vote will determine the fate of the government, which still has not been created after October Parliament elections. In case if Social Democrats will approve Grand Coalition with Angela Merkel government, EUR/USD could continue bullish trend. But if the politicians will fail to finalize negotiations, there could be a negative impact for the pair, creating additional uncertainty for upcoming months.

Next week’s economic calendar is packed with important reports and events. Main focus is ZEW survey and IFO report, but traders and investors will wait for European Central Bank interest rate decision on Thursday, followed by ECB President Mario Draghi press-conference. On one side, the market players noticed a tweak from the regulator about possible tightening decision in “early 2018”, much earlier than was widely expected previously. On the other side, there could be a concern, expressed by ECB officials, about rapid EUR appreciation since the last meeting. Export-oriented economies like Germany might have additional competition pressure because of currency gaining strength.

Cable's fall like a rock or rocket skyhigh?

British pound was one of the fastest growing currencies this past week, gaining 1.58% versus U.S. Dollar. Last time when we’ve seen the sterling above 1.3900, was the Brexit vote day in June 2016. On the fundamental front, except the USD weakness, analysts underline potential agreements between UK and EU for ‘softer’ divorce deal. This outcome of the historical decision could help British economy to avoid aftershocks and uncertainty, creating additional demand the currency, which has been undervalued during last 18 month.

Economical reports were mixed last week though: strong CPI in line with the expectations at 3.0% YoY in December, stronger-than-expected PPI, and disappointing Retail Sales declining 1.5%, the largest drop in 7 months. Next week direction will have an impact from Unemployment and Earnings figures and Q4 GDP report.

Economical reports were mixed last week though: strong CPI in line with the expectations at 3.0% YoY in December, stronger-than-expected PPI, and disappointing Retail Sales declining 1.5%, the largest drop in 7 months. Next week direction will have an impact from Unemployment and Earnings figures and Q4 GDP report.

Trading sterling assets is traditionally lucrative, with the proper risk management due to high volatility. Most of the last week’s profits came from GBP/USD, GBP/JPY and GBP/NZD pairs. Potential technical retracement is likely, which should give traders a chance to consider re-entering to long positions, following the long-term uptrend.

Loonie correction?

There are also important events on the commodity currencies market segment. While AUD/USD and NZD/USD continued recent bullish run, hitting fresh 3-month highs this past week, USD/CAD performed profit-taking pullback right after Bank of Canada rate decision last Wednesday. The regulator hiked interest rates to the highest levels since 2009, with the strong economy growth noted in 2017. But the following statement caused high volatility on the market as BoC Governor Poloz underlined potential pause in tightening and noticed further data dependence. USD/CAD traded in wide range of 200 points during 30 minutes. The pair ended the trading week with modest gains of 0.30%.

Economic reports from Canada will determine further trend direction, so USD/CAD will be very sensitive for any changes comparing to the expectations. Next week calendar highlights Wholesale and Retail Sales, with the main focus at Inflation Report due on Friday.

Economic reports from Canada will determine further trend direction, so USD/CAD will be very sensitive for any changes comparing to the expectations. Next week calendar highlights Wholesale and Retail Sales, with the main focus at Inflation Report due on Friday.

Rand and Peso lead strengthening currencies

At the Emerging Markets, currencies like USD/ZAR and USD/MXN deserve a separate attention. While South African Central Bank kept the interest range unchanged at 6.75% on past Thursday meeting, USD/ZAR hit fresh lows at 12.07200 level, first time since June 2015. Weekly decline of the pair was 1.65%, one of the most sharp and rapid weekly FX movements last week. Mexican Peso appreciation is related to rising WTI Crude Oil prices and U.S. President’s Donald Trump decision to postpone NAFTA discussions till summer elections in Mexico. USD/MXN lost 2.26% of its’ value past week, declining more than 400 points.

Further USD decline?

U.S. Dollar weakness continues 5th consecutive week. This past week, U.S. Dollar Index, measuring the world reserve currency versus the volume-weighted basket of six major opponents, fell another 0.24%, showing negative performance of 0.86% at mid-week lows. Among fundamentals, there were negative economic reports: consumer confidence, housing starts and building permits, NY and Philadelphia manufacturing activity. But the main concern for the greenback was the potential U.S. Government Shutdown. The markets closed on Friday with a pullback in major currency pairs, helping the DXY to pare some losses. But the U.S. Senate failed to pass the vote for the Stopgap Bill later, which triggered the midnight deadline to fund the government. These news are definitely negative for USD and there is a huge probability of gaps in most currency pairs on Monday market opening.

Next trading week could add more skeptical woes to the negative USD outlook, which could push DXY for further losses, despite the current rates at 3-year low level. Not much of the data to be released on the economical front. Existing and New Home Sales, Goods Trade Balance and Weekly Jobless claims do not have a significant impact traditionally. But Friday’s Core Durable Goods Orders and Q4 GDP reports are very important for the Federal Open Market Committee in the scope of possible three rate hike in 2018, announced by the regulator.

Our general outlook for the USD remains bearish, but as the rates approached to important historical levels, corrections and pullbacks are likely to happen, especially closer to the end of the upcoming week. High volatility is very probable in all assets of the financial markets with such environment. One of the main focuses for traders and investors will be U.S. Treasuries market. With the bond yields (inverse to the prices) rising to long-term high levels, despite bullish stocks indices, abroad investors would prefer to find alternatives for capital flows. This trend could continue until new U.S. Federal Reserve Chairman Jerome Powell will start his term in February.

Tuesday, January 16, 2018

EURUSD intraday long by trend

The falling USD story develops very rapidly. EURUSD hit long-term high above 1.23300 overnight and met heavy volume sellers. Taking profits pushed the pair 100 pips lower, underlying enormous volatility on the markets. This usually happens on historical and significant levels, where bulls and bears fight to death. The time will show us, who is going to win, but we are still on EURUSD bulls side. The pair is giving good price to enter the uptrend and join the party, so why should we take it? Technical setup is illustrated below.

Monday, January 15, 2018

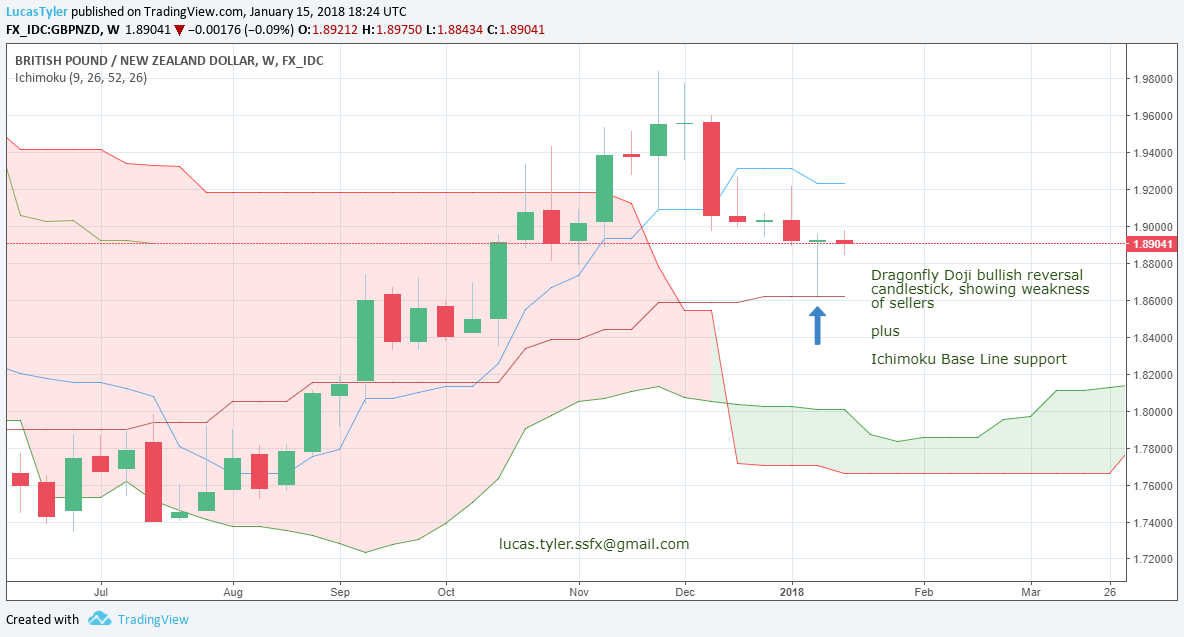

GBP/NZD reversal?

We’ve been short on GBP/NZD for several weeks, and this position has been lucrative. The arguments were posted here a while ago. But it seems like we’re facing a reversal opportunity and here is why.

As every other cross rate, GBP/NZD has two components: GBP/USD and NZD/USD. The direction of the cross rate is determined by the difference of momentum in one of the components related to the greenback. For example, one pair could rise faster than the other one and this difference creates pressure on the cross. Sometimes the components can diverge, meaning that they can move in opposite directions. In this case, the momentum of the cross rate accelerates and it moves rapidly.

Let’s try to analyze the latest performance of both components. NZD/USD has been going north for several weeks in a row, without any significant retracements. There has to be a retracement sooner or later, does not matter about further direction. We’ve got one of the first fundamental confirmations, New Zealand Electronic Card Retail Sales in December has been released weaker than previous month.

GBP/USD has more potential to rise without pullbacks. The pair has breached a level of 1.38000 on Monday, and there is no significant resistance until 1.39750 approximately. Fundamentally, there is a rumor from Britain about ‘softer Brexit’ deal with EU. Remainers camp has a majority in parliament now, so leavers cannot dictate their conditions any more. Of course, we need to get a confirmation from British economy. Inflation figures a scheduled to release today, on Tuesday and traders will be also watching the retail sales on Friday.

Technical background of possible reversal is illustrated below. We already went long on GBP/NZD yesterday, and all of our clients received these charts in time. So please contact us if you want to get fresh analysis in real time conditions.

As every other cross rate, GBP/NZD has two components: GBP/USD and NZD/USD. The direction of the cross rate is determined by the difference of momentum in one of the components related to the greenback. For example, one pair could rise faster than the other one and this difference creates pressure on the cross. Sometimes the components can diverge, meaning that they can move in opposite directions. In this case, the momentum of the cross rate accelerates and it moves rapidly.

Let’s try to analyze the latest performance of both components. NZD/USD has been going north for several weeks in a row, without any significant retracements. There has to be a retracement sooner or later, does not matter about further direction. We’ve got one of the first fundamental confirmations, New Zealand Electronic Card Retail Sales in December has been released weaker than previous month.

GBP/USD has more potential to rise without pullbacks. The pair has breached a level of 1.38000 on Monday, and there is no significant resistance until 1.39750 approximately. Fundamentally, there is a rumor from Britain about ‘softer Brexit’ deal with EU. Remainers camp has a majority in parliament now, so leavers cannot dictate their conditions any more. Of course, we need to get a confirmation from British economy. Inflation figures a scheduled to release today, on Tuesday and traders will be also watching the retail sales on Friday.

Technical background of possible reversal is illustrated below. We already went long on GBP/NZD yesterday, and all of our clients received these charts in time. So please contact us if you want to get fresh analysis in real time conditions.

Saturday, January 13, 2018

The cable is back

Latest several weeks were very positive for the british pound. It is exactly the situation when the best news is the absence of news. I mean no talks and no meetings with the allergic topic by the name of Brexit. The next week has some important economical reports though: CPI and PPI on Tuesday, Retail Sales on Friday. These reports will be a real test for the sustainability of the latest cable’s bullish achievements. In case if bulls could get a support from that side, BoE would face a stronger pressure about faster tightening, leaving the regulator not much of the choice rather than to react in a proper way. Brexit mantra won’t help any more. On the other hand, politicians could turn on the agitation machine and keep fighting with reasonable fundamental price of GBP/USD in order to push it lower. Anyway, the only thing that we can guarantee about the next week is higher-than-usual volatility.

Technically, the pound breached long-term resistance and is heading to pre-Brexit levels. Our subscribers have seen a chart like this two weeks ago:

The blue plane indicates the range of 1.3720/70 as the nearest target. Guess what is the closing price of this week? 1.3725 with the highest rate at 1.3744. By the way, guess when was the last time we’ve seen such rates of the GBP/USD? -Yes, 2016-06-23, the day after Brexit vote. Is the cable back??

Below is the updated chart with the same setup:

The price did not get in the zone between the brown and blue dotted uptrend lines, but achieve the rate target. So the resistances remain in play with a high probability of a local retracement. How deep is it going to be? That’s a question for a million. The war will show us the plan. Intraday momentum plus fundamental environment will give us a clue when to pull the trigger. Do you want to join our profitable community? Feel free to contact us.

There are also interesting situations with GBP/CAD, GBP/JPY and GBP/CHF crosses, so next week promises to be very lucrative.

Technically, the pound breached long-term resistance and is heading to pre-Brexit levels. Our subscribers have seen a chart like this two weeks ago:

The blue plane indicates the range of 1.3720/70 as the nearest target. Guess what is the closing price of this week? 1.3725 with the highest rate at 1.3744. By the way, guess when was the last time we’ve seen such rates of the GBP/USD? -Yes, 2016-06-23, the day after Brexit vote. Is the cable back??

Below is the updated chart with the same setup:

The price did not get in the zone between the brown and blue dotted uptrend lines, but achieve the rate target. So the resistances remain in play with a high probability of a local retracement. How deep is it going to be? That’s a question for a million. The war will show us the plan. Intraday momentum plus fundamental environment will give us a clue when to pull the trigger. Do you want to join our profitable community? Feel free to contact us.

There are also interesting situations with GBP/CAD, GBP/JPY and GBP/CHF crosses, so next week promises to be very lucrative.

No choice but EURO

EUR/USD pulled back down in the first half of the previous week, performing a classic and healthy retracement before breaching important long-term resistance. One of the fundamental factors, except weakness of the greenback, was ECB publishing Account of Monetary Policy meeting. There was a tweak from the regulator, a rumor about possible tapering unwind. In a simple word, the Central Bank is preparing the markets for faster decrease of the cheap borrowed capital. This change in the policy should attract foreign investors to direct capital flows to the Euro Zone. Forex speculators reacted immediately.

We went long again on EUR/USD on Thursday at 1.19622 rate and held this position through the Friday’s US CPI report. A profit of 234 pips in 32 hours is enormous for this pair. Such a rapid appreciation tell about the only possible future scenario: bullish continuation. We already showed a long-term weekly chart and we already spoke about the importance of 1.2100/2200 resistance range in one of our previous posts last week, so we do not see any reason to repeat ourselves. What’s next? ECB Inflation report scheduled for next Wednesday. CPI (YoY) is widely expected to remain at the same level at 1.4% in December. So any positive change for even 0.1% would give a lift for the pair to continue posting fresh highs. Stay tuned for our intraday analysis to determine the best level to join the party.

We went long again on EUR/USD on Thursday at 1.19622 rate and held this position through the Friday’s US CPI report. A profit of 234 pips in 32 hours is enormous for this pair. Such a rapid appreciation tell about the only possible future scenario: bullish continuation. We already showed a long-term weekly chart and we already spoke about the importance of 1.2100/2200 resistance range in one of our previous posts last week, so we do not see any reason to repeat ourselves. What’s next? ECB Inflation report scheduled for next Wednesday. CPI (YoY) is widely expected to remain at the same level at 1.4% in December. So any positive change for even 0.1% would give a lift for the pair to continue posting fresh highs. Stay tuned for our intraday analysis to determine the best level to join the party.

U.S. Dollar post-NFP collapse

The Non-Farm Payrolls report gave a temporary support to USD bulls. The main factor - earnings growth, released in line with the expectations 0.3% in December. Despite the weaker-than-expected NFP, U.S. dollar kept gaining against the majority of currencies in the first half of this week. But the growth has been stopped on Wednesday and we observed not only reversal on Thursday, but a complete crash of the world reserve currency on Friday. The main fundamental reasons were: sell-off in U.S. Treasuries, Chinese threats to stop buying bonds, traders’ and investors’ skepticism about Federal reserve ability to hike three times as they penciled during last meeting. Even stronger-than-expected Core CPI (0.3% MoM and 1.8% YoY) did not help. We’ve seen an epic battle between bulls and bears for important levels and complete defeat of bulls as the result of the week.

USD Index lost 1.26% of it’s value this week and Friday’s decline was 1.03%. Frome the technical point of view, the index broke through important supports. The first one is a local support, which used to hold the intraday prices from falling further during two weeks (blue horizontal line), and the second support is the mid-term lowest daily close on September, the 8th, 2017 (green horizontal line). As the result we have lowest value of the USD Index in three years. The daily chart is illustrated below:

There is a simple technical rule: a breached support becomes resistance. So the brown downtrend line on the chart looks to be perfect to renew shorts of the greenback. Of course, if the market would give such a gift.

USD Index lost 1.26% of it’s value this week and Friday’s decline was 1.03%. Frome the technical point of view, the index broke through important supports. The first one is a local support, which used to hold the intraday prices from falling further during two weeks (blue horizontal line), and the second support is the mid-term lowest daily close on September, the 8th, 2017 (green horizontal line). As the result we have lowest value of the USD Index in three years. The daily chart is illustrated below:

There is a simple technical rule: a breached support becomes resistance. So the brown downtrend line on the chart looks to be perfect to renew shorts of the greenback. Of course, if the market would give such a gift.

Thursday, January 4, 2018

New Film Promotion

Have you ever seen a new movie breathtaking teaser, which encouraged you to get out of your routine and run to a cinema? Wow, it’s so new, exciting and promising to change your attitude to the industry! You watch the movie and on 24th minute you realize that the story is old like centuries and scenario has been rewritten from something else… Nothing new except decorations.

Same here, on the financial markets.

Several pieces of puzzle for you to observe.

November 2016. Donald Trump became President of United States. His election promise was: ‘Let’s Make Oil Industry Great Again!’. One of the first persons he picked up in his cabinet was ex-CEO of Exxon Mobil. The result of the team hard work is illustrated below:

Two impressive observations about this weekly chart. Firstly, +50% in six last months! The price is above highest close in 2.5 years! Secondly, look at the speed how fast the price moved through highlighted range $60.00 - $80.00 in 2014 during sell-off. Wow, 2000 pips or -25% in 7 weeks! My point is that we could see a mirror bullish run. Try to draw a right wing of this unfinished masterpiece, wouldn’t it be symmetric?

April 2017. French presidential election. Emmanuel Macron beats Marine Le Pen. Dejavu? A male candidate representing big money sacks beats a female with doubtful reputation. Or is it a new movie???

EUR/USD reacts immediately. Below is a weekly chart. The April weekend gap will not be filled for a long long time. Tell me please, do you think these lines are parallel by a coincidence? I will tell you, what is happening now. We are entering into new long term bullish channel. Nearest target is at least to come back to lows of October 2008 - February 2009. It is 1.25000. I used to short EUR/USD from 1.60000, so please don’t tell me that 1.25000 is very high level.

September 2017. Stanley Fischer, Federal Reserve System Vice Chairman announced his resignation, leaving the Board of Governors three months before Chairwoman Yellen term expiration. Official reason is ‘personal circumstances’. I translate his message: ‘I do not want to play your games, guys. The market will not buy this stuff’. October 2017. FOMC announced three rate hikes in 2018 despite the lack of inflation. December 2017. FOMC insisted on three upcoming rate hikes, US Dollar trashed:

Look also at US Stock indices, gold, other commodities and commodity currencies, emerging market currencies. You will see the same picture everywhere. Traders and investors are searching for any asset, not to stay in cash USD, which is losing its’ value due to the Fed policy.

Do you really think that NFP report today would change anything in this overall picture?..

The greenback's destiny has been decided a long time ago.

November 2016. Donald Trump became President of United States. His election promise was: ‘Let’s Make Oil Industry Great Again!’. One of the first persons he picked up in his cabinet was ex-CEO of Exxon Mobil. The result of the team hard work is illustrated below:

Two impressive observations about this weekly chart. Firstly, +50% in six last months! The price is above highest close in 2.5 years! Secondly, look at the speed how fast the price moved through highlighted range $60.00 - $80.00 in 2014 during sell-off. Wow, 2000 pips or -25% in 7 weeks! My point is that we could see a mirror bullish run. Try to draw a right wing of this unfinished masterpiece, wouldn’t it be symmetric?

April 2017. French presidential election. Emmanuel Macron beats Marine Le Pen. Dejavu? A male candidate representing big money sacks beats a female with doubtful reputation. Or is it a new movie???

EUR/USD reacts immediately. Below is a weekly chart. The April weekend gap will not be filled for a long long time. Tell me please, do you think these lines are parallel by a coincidence? I will tell you, what is happening now. We are entering into new long term bullish channel. Nearest target is at least to come back to lows of October 2008 - February 2009. It is 1.25000. I used to short EUR/USD from 1.60000, so please don’t tell me that 1.25000 is very high level.

September 2017. Stanley Fischer, Federal Reserve System Vice Chairman announced his resignation, leaving the Board of Governors three months before Chairwoman Yellen term expiration. Official reason is ‘personal circumstances’. I translate his message: ‘I do not want to play your games, guys. The market will not buy this stuff’. October 2017. FOMC announced three rate hikes in 2018 despite the lack of inflation. December 2017. FOMC insisted on three upcoming rate hikes, US Dollar trashed:

Look also at US Stock indices, gold, other commodities and commodity currencies, emerging market currencies. You will see the same picture everywhere. Traders and investors are searching for any asset, not to stay in cash USD, which is losing its’ value due to the Fed policy.

Do you really think that NFP report today would change anything in this overall picture?..

The greenback's destiny has been decided a long time ago.

The king is dead, long live the King!

Tuesday, January 2, 2018

Scared Little Bird, or How An Individual FX Trader Survives in Volatile Environment.

Sometimes I see the markets as jungle. Thousands of animals trying to find a way to eat each other. Some of them are big predators, hunting for their victims, the others run and hide. Everyone is hungry though, and the task is to eat some food, but not to become a food for someone. I imagine myself as a scared little bird sitting on a tree in a safe haven zone (squared). No predator can reach me here, but there is no food (profit) though. I’m watching what’s happening on the ground near this tree, trying to search for a piece of food. I realize that my biggest advantage comparing to big predators (hedge funds, institutional investors, huge banks) is the SPEED. I can fly down rapidly from my safe place on the tree, grab my piece of profit and come back to safety in a blink of an eye. So when I see volatility period is coming, I’m looking only for quick deals. If I understand that I’m stuck with a position for a longer time that I was hoping for, I just drop it and run away. Tight stop losses also are a must in volatility period.

What’s happening in the bush currently? I recall very similar period as it was in the end of August - beginning of September 2017. Same rally in worldwide stock indices led by historical highs in U.S. NASDAQ posted all-time high closing levels yesterday. Commodities have a bullish run with oil above $60 and gold above $1300. Euro is above 1.20. Most of traders are running to any asset, not to stay in cash (the greenback as cash here). Sell-off in USD. But suddenly a scarecrow is coming out from nowhere: “Nuclear war eyes on horizon! Run back into cash!” And some of the traders reverse their greed-on mode to fear-on. But the others wait behind the corner and buy what those sell. The only difference now is that two fat guys tweet each other, who’s button is bigger...

Allright, jokes apart, let’s be serious. I got nothing to do with nuclear war tweets, but ignore them. I’m waiting for FOMC Meeting Minutes to see the next wave of disappointment in the greenback. Fed is obviously behind the curve. Yellen tried to be hawkish in October and she had some temporary success with the greenback retraced from lows. But they had a tax reform positive expectations that time. What do they have now? Growing budget deficit, growing external debt and growing negative trade balance? Oh, yes, they also have a growing disappointment in the tax reform. What is an alternative way to turn the attention from these problems rather than to talk about nuclear buttons? So I expect nothing, but disappointment from the upcoming Minutes today.

We went long on EUR/USD again on the retracement yesterday, and we’ll be looking to add longs later today. But we keep in mind Scared Little Bird tactics, and our stop-loss orders are tight. A deep retracement is still possible, cause the upcoming NFP report could have rumors about strong employment in U.S. and could bring the greenback bulls some fresh air to breath.

Gold went big path in a very short period of time. Look at two charts of gold futures below. First one has been posted on December 19th, the second one is from today.

Almost 800 pips and almost +7% in two weeks!! What a run!

But they need a retracement if they want to proceed. At least the price needs to come back down to the last breached resistance around $1308.00/1309.00. Please note that I mean here Gold futures. The prices of CFDs for Gold are usually couple of bucks lower.

One more interesting observation is about the British Pound. Fundamentally, it’s been underpriced in my own opinion. Brexit mantra does not have such an impact as it was described by BoE officials. They only use it as the justification to keep the interest rates at low levels and compete on the external markets thanks to the currency slower growth comparing to others, like Euro for example.

But look, what’s happening nowadays? Sterling breaks some important technicals. Especially versus the Japanese yen. Well, we see it this way: a lot of traders got used to play ping-pong with the pound pairs. It’s very easy to sell it when it goes up and reverse on certain lower levels. But seems like someone big is trying to catch an additional haul to the nets, hunting for stop-losses, margin calls and traders who do not adopt for changed environment. You may see below two interesting daily charts of GBP/USD and GBP/JPY.

GBP/USD is back above 1.36000 as I write these words, second time since Brexit vote with the highest daily closing prices in the period. GBP/JPY is very close to breakthrough an important technical resistance, which held for a while with several failed attempts before. Will it stand this time? I doubt.

Aggressive intraday longs of these two pairs with a target of 100..150 pips could be a quick piece of food for the Scary Little Bird on the tree.

What’s happening in the bush currently? I recall very similar period as it was in the end of August - beginning of September 2017. Same rally in worldwide stock indices led by historical highs in U.S. NASDAQ posted all-time high closing levels yesterday. Commodities have a bullish run with oil above $60 and gold above $1300. Euro is above 1.20. Most of traders are running to any asset, not to stay in cash (the greenback as cash here). Sell-off in USD. But suddenly a scarecrow is coming out from nowhere: “Nuclear war eyes on horizon! Run back into cash!” And some of the traders reverse their greed-on mode to fear-on. But the others wait behind the corner and buy what those sell. The only difference now is that two fat guys tweet each other, who’s button is bigger...

Allright, jokes apart, let’s be serious. I got nothing to do with nuclear war tweets, but ignore them. I’m waiting for FOMC Meeting Minutes to see the next wave of disappointment in the greenback. Fed is obviously behind the curve. Yellen tried to be hawkish in October and she had some temporary success with the greenback retraced from lows. But they had a tax reform positive expectations that time. What do they have now? Growing budget deficit, growing external debt and growing negative trade balance? Oh, yes, they also have a growing disappointment in the tax reform. What is an alternative way to turn the attention from these problems rather than to talk about nuclear buttons? So I expect nothing, but disappointment from the upcoming Minutes today.

We went long on EUR/USD again on the retracement yesterday, and we’ll be looking to add longs later today. But we keep in mind Scared Little Bird tactics, and our stop-loss orders are tight. A deep retracement is still possible, cause the upcoming NFP report could have rumors about strong employment in U.S. and could bring the greenback bulls some fresh air to breath.

Gold went big path in a very short period of time. Look at two charts of gold futures below. First one has been posted on December 19th, the second one is from today.

Almost 800 pips and almost +7% in two weeks!! What a run!

But they need a retracement if they want to proceed. At least the price needs to come back down to the last breached resistance around $1308.00/1309.00. Please note that I mean here Gold futures. The prices of CFDs for Gold are usually couple of bucks lower.

One more interesting observation is about the British Pound. Fundamentally, it’s been underpriced in my own opinion. Brexit mantra does not have such an impact as it was described by BoE officials. They only use it as the justification to keep the interest rates at low levels and compete on the external markets thanks to the currency slower growth comparing to others, like Euro for example.

But look, what’s happening nowadays? Sterling breaks some important technicals. Especially versus the Japanese yen. Well, we see it this way: a lot of traders got used to play ping-pong with the pound pairs. It’s very easy to sell it when it goes up and reverse on certain lower levels. But seems like someone big is trying to catch an additional haul to the nets, hunting for stop-losses, margin calls and traders who do not adopt for changed environment. You may see below two interesting daily charts of GBP/USD and GBP/JPY.

GBP/USD is back above 1.36000 as I write these words, second time since Brexit vote with the highest daily closing prices in the period. GBP/JPY is very close to breakthrough an important technical resistance, which held for a while with several failed attempts before. Will it stand this time? I doubt.

Aggressive intraday longs of these two pairs with a target of 100..150 pips could be a quick piece of food for the Scary Little Bird on the tree.

Monday, January 1, 2018

USD bears to control the first trading week of 2018?

The last trading week of 2017 was not packed with major economic events and reports. But despite that fast, the markets moved sharply across the board, posting several technical important achievements. EURUSD closed the week above significant psychological rounded mark of 1.20000. GBPUSD breached above 1.35000, spot Gold CFD prices are nearing $1300.00 per ounce, first time since early September 2017; Crude oil. WTI closed the week above $60.00 per barrel, first time in 30 month.

There are several explanations about such a weakness of the greenback. We already talked about some of them. Federal Reserve needs to much more hawkish and convince the markets before they will reverse back to bullish USD sentiment. U.S. stock are facing a period of uncertainty with more bearish emphasys in January, which also does not add support to bulls.

The upcoming week is full of important data to kick-off the start of busy 2018. Monday is traditional holiday in a lot of countries worldwide and very low volume of trading is expected with almost zero volatility. The markets players will be back to working places since Tuesday and start watching such reports as China Caixin, German, British and U.S. Manufacturing PMIs. Retail Sales from Switzerland, Germany Unemployment, British Construction PMI, U.S. ISM Manufacturing PMI reports will determine the trading sentiment on Wednesday before possible high volatility during FOMC Minutes to be released at 07:00 PM GMT. Thursday has a pack of data from Europe and UK and ADP employment change together with Crude Oil Inventories from U.S. European CPI, U.S. December Non-Farm Payrolls and Canadian unemployment on Friday will be among the main events of this upcoming week to determine trading direction for a bunch of assets on the financial markets.

It’s reasonable to expect high volatility with such a heavy economic calendar. But it feels like the bears have to have a break, renew strength and reload technical indicators whether by a pullback or sideway horizontal consolidation range. One of the first triggers to renew the wave of the greenback sell-off could be FOMC Meeting Minutes on Wednesday. So we prefer to have a wait-and-see strategy before that. Of course, we’ll be looking at some crosses for intraday trading opportunities.

U.S. Dollar Index is nearing to overbought levels. But the Bollinger Bands indicator signals a bearish continuation by closing the day below the Band. The daily chart is shown below.

Any retracements has to be considered as selling opportunities if the fundamental environment will keep disappointing investors and traders.

We will update the trading plan for this upcoming week and we will observe more currency pairs attractive for trading later. We are also going to host a live trading session on Friday’s U.S. NFP report, so stay tuned for updates.

There are several explanations about such a weakness of the greenback. We already talked about some of them. Federal Reserve needs to much more hawkish and convince the markets before they will reverse back to bullish USD sentiment. U.S. stock are facing a period of uncertainty with more bearish emphasys in January, which also does not add support to bulls.

The upcoming week is full of important data to kick-off the start of busy 2018. Monday is traditional holiday in a lot of countries worldwide and very low volume of trading is expected with almost zero volatility. The markets players will be back to working places since Tuesday and start watching such reports as China Caixin, German, British and U.S. Manufacturing PMIs. Retail Sales from Switzerland, Germany Unemployment, British Construction PMI, U.S. ISM Manufacturing PMI reports will determine the trading sentiment on Wednesday before possible high volatility during FOMC Minutes to be released at 07:00 PM GMT. Thursday has a pack of data from Europe and UK and ADP employment change together with Crude Oil Inventories from U.S. European CPI, U.S. December Non-Farm Payrolls and Canadian unemployment on Friday will be among the main events of this upcoming week to determine trading direction for a bunch of assets on the financial markets.

It’s reasonable to expect high volatility with such a heavy economic calendar. But it feels like the bears have to have a break, renew strength and reload technical indicators whether by a pullback or sideway horizontal consolidation range. One of the first triggers to renew the wave of the greenback sell-off could be FOMC Meeting Minutes on Wednesday. So we prefer to have a wait-and-see strategy before that. Of course, we’ll be looking at some crosses for intraday trading opportunities.

U.S. Dollar Index is nearing to overbought levels. But the Bollinger Bands indicator signals a bearish continuation by closing the day below the Band. The daily chart is shown below.

Any retracements has to be considered as selling opportunities if the fundamental environment will keep disappointing investors and traders.

We will update the trading plan for this upcoming week and we will observe more currency pairs attractive for trading later. We are also going to host a live trading session on Friday’s U.S. NFP report, so stay tuned for updates.

Subscribe to:

Comments (Atom)

Don't try. Do. Action is something that brings you to the next level. You should keep in mind that no thought, no word can enhance your ...

-

Don't try. Do. Action is something that brings you to the next level. You should keep in mind that no thought, no word can enhance your ...

-

Please note, that this article comes from my archive. Check the actual date in the header. The Greenback decline over the first half of...

-

You can find a lot of sources for fundamental news about crypto and Bitcoin. This topic became very popular, so top news agencies picked it...